Of all the classical “7 Powers,” brand has always seemed the flimsiest to investors. You can’t model it well in Excel. It’s binary (you either have it or you don’t), and often retroactive. Teams tell themselves they had a brand after customers start showing up.

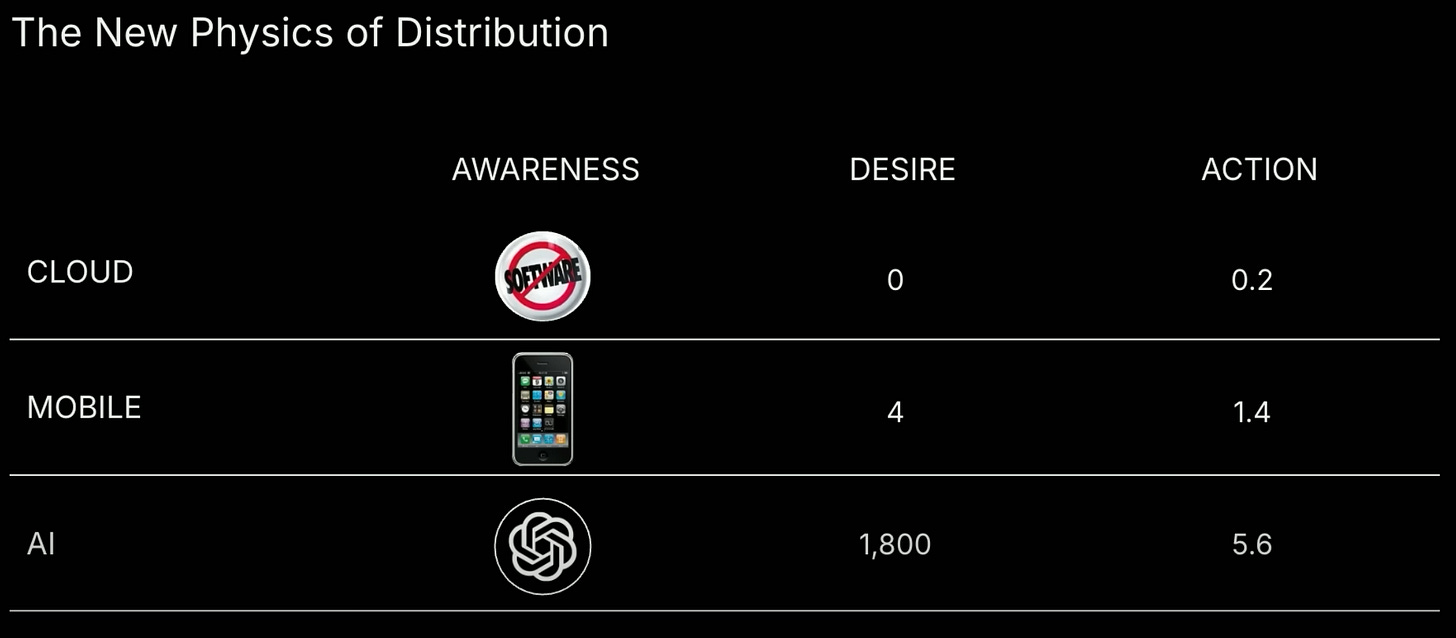

In past waves, distribution was the bottleneck. You had to manufacture awareness, persuade into desire, and then drag a buyer over the line to action. In today’s frothy AI wave, those inputs have flipped. Awareness is ambient. Desire is often a mandate (managers at companies are now given mandates to “incorporate AI” into their workflows). Action is a procurement checklist.

The physics of distribution comes down to three core principles: people have to know about your thing (awareness), people have to want your thing (desire), and people have to be able to buy your thing (action).

When distribution becomes abundant, credibility is scarce. That’s the new physics.

Awareness is no longer the moat; the feed and the press do that for you.

Desire is no longer purely product-driven; it’s culturally and politically driven (“we need an AI plan”).

Action is gated less by clicks and more by risk: security, compliance, reputation, career risk.

Defaults beat benchmarks

Founders love feature tables, but buyers choose defaults. Whether Model A edges Model B on a leaderboard matters less than who owns the slot in the mind and the slot in the workflow. “Use ChatGPT” is a habit, and habits compound. The same logic drives vertical AI: win a flagship account in law or healthcare and you don’t just get revenue as a prize. You also mint a reference that other cautious buyers can point to when they say, “we chose the safe thing.”

I think this is why seemingly “worse” products can win early: not because quality doesn’t matter, but because the first credible default gets time to catch up. The clock you buy is the only real moat in fast markets.

Where brand is a force multiplier

High-trust, regulated categories (law, healthcare, finance). The cost of being wrong is career-ending. Here brand substitutes for lengthy due diligence. A few flagship customers function as public proofs. Procurement treats your logo wall like evidence. Two main things to focus on here are:

Referenceability — the right names use you, publicly. (In old sectors, one correct reference beats twenty minor ones.)

Examples: Harvey targeting major prestigious law firms like Allen & Overy first (knowing the smaller firms would fall in line after), OpenEvidence and Abridge with doctors

Narrative — a crisp explanation of why you will keep winning. Buyers don’t just buy what is; they buy a trajectory.

Cognition with coding agents. The team speaks for itself with its slew of IOI medalists.

Consumer habits. In ambients like chat or search, brand becomes the reflex. Once the mental path is cut, switching requires friction or a 10× gain.

Example: ChatGPT vs Gemini

Where brand won’t save you

Low-risk, self-serve tools with commodity switching. If the product doesn’t deliver in the first session, churn will erase any brand premium. Memes can fill the top of the funnel; they cannot hold the bucket.

Example: Icon, the AI ad maker

Final words

Thiel says competition is for losers because it grinds margins to zero. In AI, raw distribution pushes you toward perfect competition: everyone can reach everyone. Brand is how you exit that equilibrium. It creates a local monopoly of trust: for this buyer, in this context, you are the only safe choice.

Brand is probably still not as effective as the other powers as a moat, but founders shouldn’t treat it as a throwaway line item like they have in previous technology waves. They need to think critically about whether they need a proper brand strategy.